How we can help you

Whatever the transaction type, Powdr is here to help make the process successful

Our models – by linking operational drivers to financial output - help management teams and external parties see the full picture.

Output is displayed in a way that banks and investors understand, thus allowing them to make a decision based on the data provided (rather than an outright rejection due to poor data input).

Our software is unbreakable, and can be updated with the click of a button month on month, helping you also meet the demands of monthly MI and reforecasting required in your agreement with you financial partner.

It's why we are trusted partners with so many banks and funds; and why you can trust in us to help you through the transaction you are about to embark on.

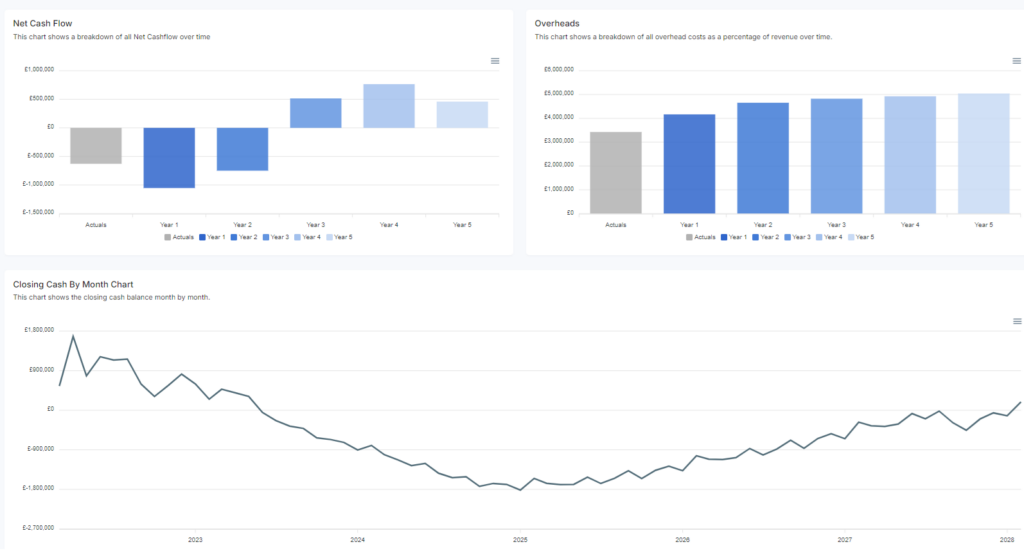

Powdr’s output makes it easy for both you as the business owner and your potential investors to understand the financial drivers of your business and thus better understand how you can generate profit and maximise your margins.

Powdr is displayed in a way that brings your strategy to life, but also offers the ability to stress test the inputs, allowing investors to build both confidence in your strategy but also know the impact if things don’t go as planned.

This gives potential investors confidence in both you and your business. A well thought out financial model improves the chances of success for investment!

Powdr offers a variety of debt modelling assumptions allowing you to model how different debt structures could support your business.

A well thought out model, linked to your KPIs along with a clear strategy of what type of debt you need and how this will be utilised, and importantly, repaid is exactly what a bank needs to see before terms will be agreed. Powdr can help you with this.

If you are having cashflow concerns you are not alone! Recent estimates suggest up to 70% businesses are in the same boat.

Powdr can help you break down your finances and forecasts in a way that helps you pinpoint the areas for focus when it comes to your cashflow. Whether its a near term concern or one related to further in the future, Powdr can help you understand the levers you have at your disposal to get your business through, or helps you model debt options that can be your lifeline through bumpy periods.

Did you know....

Between 40 and 50% of bank funding applications from small businesses get rejected each year, and many more are discouraged from applying in the first place.

Recent stats also suggest 70% of business owners have cashflow concerns

We know first hand that the key to successful financial transactions and strong cashflows is entwined with arming management with an understanding of how their decisions and choices impact the bottom line.

By leveraging technology and the power of AI, business' of all sizes can create a credible forecast for the fraction of the cost of the alternative consultant.

What's more, with years of experience in financial modelling, we are also on hand to offer as little or as much consultancy as you might need depending on your situation.

Years of experience across banking, restructuring, consultancy & building models to support such transactions make us well equipped to support you on your journey.

Our CEO and co founder Joe has recognised this problem since he first started working at a bank yet was always powerless to do anything but refer small companies to expensive consultancies. After years of honing his unique modelling technique specifically to support financial transactions he worked alongside a highly skilled team to develop Powdr.

But we haven't stopped there!

Since our launch we've been dropping new features every month and will continue to do so. We will continually strive to offer our customer's the best possible software based modelling and support that they can get on the market today.

We have experience across a huge number of sectors, from small start-ups to large corporates however Powdr has been built to best support start ups, SMEs and Medium corporate sized businesses. We do offer consolidation features if you have multiple businesses that you need overall visibility of too.

Whether you are applying for investment, debt or in need of support to better understand potential cashflow issues, our software is purposefully built with your business in mind.

At Powdr we are committed to supporting businesses to understand the importance of forecasting.

When you use Powdr, you aren't just getting a model that will be used for the transaction or support you need at a point in time. You get a model that can be easily updated month to month and adapted and changed as your business changes. Making it a tool that will become part of your monthly analysis and feed into leadership conversations and strategy.

Meet the team

We're here to help

With a passion for innovation and dedication to excellence, our team has unique blend of experience to bring you our unique software modelling tool with experienced consultancy support as you need it.

Joe van Gelder

CEO and Foundr

- Email:joe@powdr.co.uk

Steve Foster

CTO and Foundr

- Email:steve@powdr.co.uk

Nicola Jones

COO and Foundr

- Email:Nicola@powdr.co.uk

Let's get started

See how Powdr can help your business plan for the future

Book a no obligation demo with Powdr