The world of financial forecasting is often misunderstood or mistaken for day to day budgeting or trend analysis. In fact, having a financial forecast built by your leaders, based on your strategy, representing your business KPIs is something that every business should have, even if they don’t realize it just yet.

The ability to clearly articulate a company’s strategy and understand its impact on financial forecasts can be the difference between success and failure. But it’s not just about having a strategy; it’s about knowing how that strategy influences every financial decision and projection the business makes.

A well-defined strategy serves as the guiding light for all business operations. It provides direction, aligns resources, and sets expectations for growth. When a business understands how its strategy will impact revenue, costs, and profits, it can make more informed decisions, allocate resources more effectively, and prepare for the future with confidence. This is something that a day to day forecast budget tool, or a trend analysis forecast cannot do for you.

Further to having a base forecast that represents your strategy as numbers it’s also important to be able to adjust your financial models easily and see the immediate impact on your cashflow, allowing your business to be agile, responsive, and resilient.

Imagine a scenario where market conditions shift, a new competitor enters the field, or supply chain disruptions occur. If your business can quickly pivot, adjusting revenue projections, cost structures, and cash flow forecasts in real-time, you gain a competitive advantage. This ability to stress-test assumptions isn’t just about survival—it’s about thriving in uncertainty.

Furthermore, the ability to change assumptions and structure as you go with a financial forecast empowers leadership teams to have more meaningful discussions around risk management and opportunity identification. By understanding the financial implications of different strategic choices, businesses can make more deliberate and confident decisions. They can also better communicate these choices to stakeholders, backed up by numbers, ensuring that everyone is on the same page and working towards the same goals.

In conclusion, a business that is clear on its strategy and understands how that strategy impacts its financial forecasts is positioned to lead with purpose and precision. The bonus? The ability to quickly manipulate figures to stress-test assumptions adds a layer of agility that is invaluable in today’s ever-changing business landscape. For those companies willing to invest in this strategic clarity and financial dexterity, the rewards are immense—sustainable growth, improved resilience, and a stronger competitive edge.

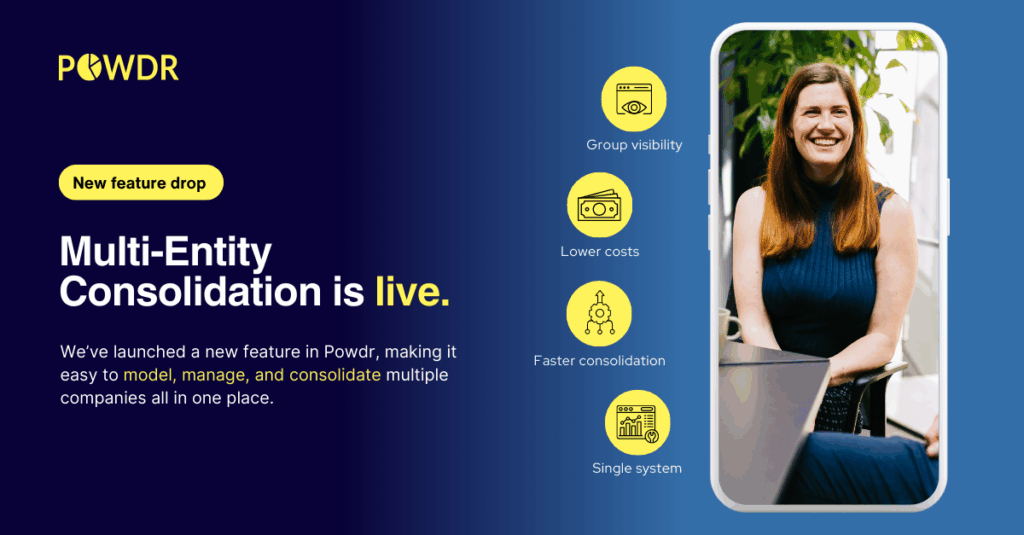

Get in touch to understand how Powdr can help your business to translate it’s strategy into a viable financial forecast that can be easily updated to reflect whatever changes come your way.